Getting ready to graduate? Congratulations! Graduating from high school is a major accomplishment worth celebrating. But as your high school career comes to an end, make sure you’re on track to meet all graduation requirements. In Texas, that includes submitting a financial aid application.

Why? Because Texas wants more students to get money to help pay for college or training after high school. And to get financial aid, you have to apply for it. Every year, billions of financial aid dollars go unclaimed by students, simply because they aren’t applying for aid.

If you’re thinking, “I don't need financial aid because college or training after high school isn’t for me,” you might consider this: by the year 2030, over 60% of jobs in Texas will require some sort of training or credential beyond high school. So getting education after high school will help you compete in the Texas workforce. There are many pathways you can take to get that education and training. Financial aid can help with all of them. Be sure to visit My Texas Future to explore college and career programs that fit your goals, interests, and abilities.

Trying to grasp why financial aid matters and how to meet Texas' financial aid application graduation requirement? Keep reading to learn:

- About Texas' financial aid application graduation requirement

- What financial aid is

- How to complete your financial aid application

- Where to get more support

- How to follow up on your financial aid application

Note: When available, we will provide links to documents and resources in both English and Spanish. When translations are not available, or to view links in other languages, consider using a Google Chrome browser and use the translate function.

|

Get to know Texas’ financial aid application graduation requirement Since the 2021–22 school year, all students have needed to take one of the following actions to graduate:

|

|

|

Who should opt out? In certain cases, students can opt out of the graduation requirement by submitting a signed opt-out form to a school counselor or administrator. This form is also available in Spanish. You can make this decision based on personal circumstances. Your school counselor can help answer questions, address your concerns, and provide guidance regarding this graduation requirement and which choice may be the best fit for you. Students 18 and younger may also need a parent or guardian’s signature, unless a student is considered an emancipated minor or there is a special circumstance that may prevent a parent or guardian from being able to sign. If you’re unable to get a parent signature, your school counselor can sign the form with you. Remember, you can always apply for financial aid later, even if you choose to opt out of the graduation requirement. |

|

Learn about financial aid We know that financial aid might be a new concept for you. Before starting a financial aid application, consider this:

|

|

|

Why should I care about applying for financial aid? What financial aid is out there?

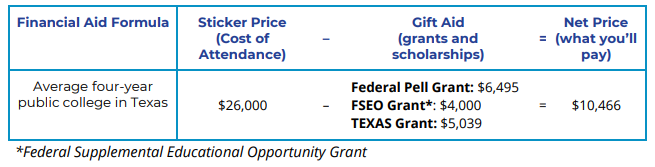

It may feel like applying for financial aid requires you to learn a new language! Familiarize yourself with commonly used financial aid terms using College Board’s BigFuture Financial Aid Glossary. How will financial aid help me pay for college? But it’s likely that you won’t have to pay the full sticker price. To discover what you will pay to attend a specific program after high school, you have to find the net price. The net price is the school’s COA (sticker price) minus any grants or scholarships you receive. Remember, that’s free money you don’t have to pay back. You can cover the net price using other forms of financial aid such as work-study funds or loans. Or you can pay it through personal savings, job earnings, or family support. See how financial aid can help you lower your education costs each year:

The table is also available in Spanish. Note: The table reflects max award amounts for each grant. Students without significant financial need may receive less than what is listed. Conversation starter: Most students need to report parent information on their financial aid application. Share this financial aid table with your family, so they understand how their help can benefit you! What is the truth about financial aid applications? You may be confused about applying for financial aid, or maybe you think that it’s not worth all of the extra work because you think you won’t qualify to receive aid. Some people may even be nervous about completing an application that requires sensitive personal information. Check out this helpful resource on Debunking Financial Aid Myths in English or in Spanish to learn the truth about these applications so that you can make the best decision for yourself. |

|

Get ready to complete your financial aid application Now that you know the benefits of applying for financial aid, it’s time to answer the following questions:

Keep reading to get the answers you need. |

|

|

Which application should I complete? You can complete one of the following applications to apply for financial aid:

Note: Your parent’s citizenship status does not impact your eligibility for financial aid. When can I apply for financial aid? Every year, both the FAFSA and TASFA open October 1. This is the earliest date you can apply to receive aid during the upcoming school year. State and colleges use financial aid application information to award their own grants, scholarships, and loans, so you should aim to submit your application as soon as possible after the application opens. This will improve your chances of qualifying for the most grant, scholarship, and work-study aid. There are three major financial aid deadlines to mark in your calendar:

*Note: The Texas Higher Education Coordinating Board has updated the 2025–26 state priority deadline from January 15 to February 15, 2025 for the 2025–2026 application year. Pro tip: For financial aid, each school year starts on July 1 and ends on June 30 of the following year. Make sure your application is for the school year in which you need financial aid, not the current academic year. Resource spotlight*: Print or bookmark this Financial Aid Timeline in English or in Spanish to keep track of important deadlines. *Note: This resource does not reflect the current priority deadline of February 15, 2025, since it is a temporary deadline for 2024–2025. Need regular reminders to help you stay on track? You can receive free virtual advising support via text message! Texas Higher Education Coordinating Board developed a chatbot named ADVi– short for advisor – to provide you with on-demand support to help ensure that you receive the information you need to access higher education. When you sign up to receive messages from ADVi, you get:

If you're a high school senior, you can sign up for ADVi texts through your ApplyTexas account. Once logged in, go to your Account Preferences and edit your Notification Preferences. Provide your mobile number and agree to receive texts from ADVi by turning your text message settings to On. Save your changes, and you should receive your first text within a week! Currently, ADVi only sends outgoing text messages in English. However, you can ask ADVi to respond to your questions in a different language by texting #language (Don't forget the #!). You can also text #followup at any time to forward your message to a Spanish-speaking college advisor.

Completing a financial aid application is quick and easy if you have the right information and know who to ask for help. Just follow these steps:

How do I apply?

If you do the right work ahead of time, the application should take less than an hour to complete! |

|

Get support on your application Ask your school counselor or college and career advisor about support to complete your application. Your high school might host financial aid events to help students and their families. You can also schedule a meeting with your school counselor for one-on-one support. More support may be available in your community too. |

|

|

Keep this in mind: the better your school counselor or adviser understands your needs, the better they can support you on your application.

If you want to complete your application at home, check out the following resources:

|

|

Follow up on your financial aid application After you submit the FAFSA or TASFA, you’ll need to take a few more steps to ensure that you have the financial aid you need for college or training after high school. Review this list of action items below. |

|

Big takeaways:

Visit Federal Student Aid for more information on next steps after submitting your financial aid application. |

______________________________________________________________________________________________________________________________________

Resource library

Now that you know more about Texas’ financial aid graduation requirement and how to apply for financial aid, explore the following resources to get the support you need.

Learn about financial aid

|

Get ready to complete your financial aid application

|

Complete your financial aid application

|

Know what to do after you submit your financial aid application

|